From Paycheck to Prosperity: How to Organize and Automate Your Money

Best practices once you've started making enough money

Congratulations! You’re making good money now! Good enough that you even have some left over. What the heck do you do with it?

Welcome back to part 3 of Coins to Comfort, the series where I walk you through exactly how I help my clients create a better relationship with their money. In this part of Coins to Comfort, we'll cover how to organize your money so it works for you effortlessly, allowing you to save, invest, and grow wealth—without constantly worrying about it slipping through the cracks.

Automating Your Money

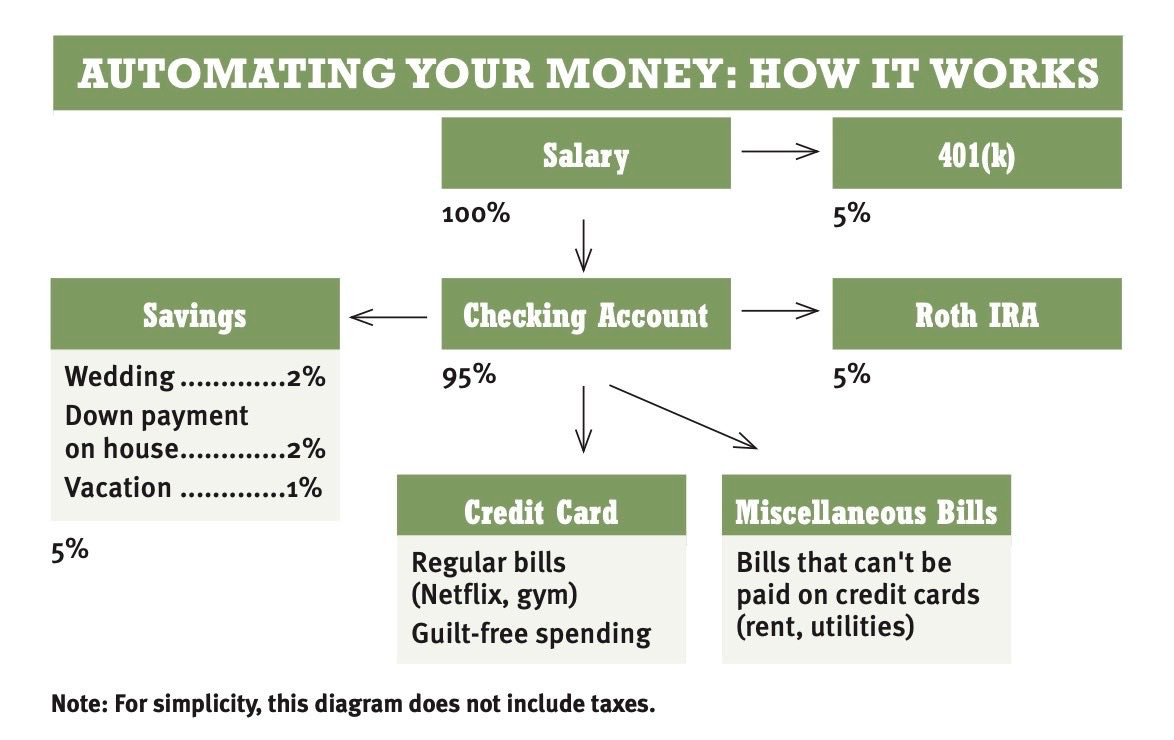

One of the biggest challenges I see with my clients is that life gets busy, and they forget to stay on top of things like saving or paying bills. Automation is your secret weapon against this. Automation takes the mental load off you, freeing you to focus on enjoying life, knowing your financial future is already in motion. Here is a diagram made by Ramit Sethi (author or I Will Teach You to Be Rich) that lays out a good model for automating your money:

Investments

You can see in this diagram that you have your salary which your 401K (if you have one) automatically takes 5% out of.

Quick Aside: 401Ks are actually not the best investment vehicles but the reason they are a huge deal is because most of the time companies will offer a match. Basically whatever you contribute they will match up to a certain percentage of your paycheck. If your work offers this be sure you contribute up to the match! It is shattering amounts of money in the long run! So many people that I work with don’t contribute to their 401K when we first start working together and after they start contributing they are blown away but how fast it grows.

Over the course of your career, that match could add up to tens of thousands—even hundreds of thousands—of dollars. It’s free money!

Okay back to automating your money: So once the 401K takes out its chunk then the rest of the money transfers into your bank account. From there another 5% goes into a ROTH IRA which is one of the best investment vehicles out there. Here’s why:

In the world of finance there are qualified and non-qualified accounts. These are fancy words that mean either taxes have not been taken out yet (qualified) or taxes have been taken out (non-qualified). A ROTH IRA is considered a qualified account.

“But wait didn’t you say I contribute with money from my bank account? Isn’t that after tax?” Yes it is. Weird right? But it gets even weirder. Normally for a qualified account when you withdraw money out of it you have to pay taxes on it because you haven’t paid any yet. Even on a non-qualified account you have to pay taxes on any gains (money you make from the investment) once you make a withdraw. But with a ROTH IRA it is completely tax free.

Imagine you contribute to a Roth IRA now, and in 20 years you withdraw $50,000. Normally you'd owe taxes, but with a Roth IRA, that entire $50,000 is yours, tax-free. This is why the Roth IRA is so powerful—it allows your money to grow tax-free, which can be a huge win for your future self.

Okay, so you set it up so 5% goes to your ROTH IRA

Savings

From there another 5% automatically goes into savings. For a lot of the clients that I work with they hate savings. It’s something that takes away from the money that they have to spend and they just have to sit there and look at it, like a dog looking at a bone. Here are some things that help a lot of the clients I work with create a better relationship with their savings accounts

Make multiple savings accounts and give them categories: Just saving for a rainy day sucks! “I sure hope one day I get to touch my own money.” Saving for a particular goal can be exciting. So think about what you would like to do with your money. Do you want to travel? Make a travel savings. Do you want to buy a house? Making a house savings etc. This way you get excited about the number growing because you know that when it reaches the right number you’re going to be able to do something that brings you joy. Naming each account gives you a sense of purpose and excitement as you watch that vacation fund or house deposit grow. Suddenly, savings stop feeling like a restriction and start feeling like a reward for future goals.

Make your savings accounts with a separate bank: Us humans have dumb monkey brains and for our dumb monkey brains a lot of things are out of sight out of mind. So instead of having your savings account right next to your checking account every time you open up your bank app, open your savings account with another bank. This makes it so you don’t see if as often and it makes it less likely for you to make an impulsive decision because if you want the money out of the savings account you have to wait 3 days for the transfer.By having your savings out of immediate sight, you'll be less tempted to dip into them for impulse purchases.

Credit Cards

DUN DUN DUN! This one could probably be a whole article by itself but I’ll try to keep it simple.

Don’t get a credit card if you know you will overspend. It’s not worth it. Just live off your cash.

Once you start using credit cards your bank account balance is no longer a reliable number to look at. It may look like you have $2,000 in your bank account but if you have $1,900 on a credit card you actually only have $100. Tracking your money becomes vitally important. Your budget is now the only number you can rely on.

Credit cards can be powerful tools if used wisely—but if you tend to overspend, they can do more harm than good. If you're confident in your spending habits, setting up automatic payments can help you stay on track without worrying about late fees. Set it up to automatically pay off the statement balance every month. One cool advantage of this is that usually the statement balance and the card balance are not the same so it gives you a little bit of flexibility with your money. This doesn’t mean spend money you don’t have, it just means that if you need to spend a little more in the beginning of the month, you’re not bottlenecked because you’re waiting for your next paycheck.

Sign up bonuses are great but don’t go crazy. A lot of credit cards will give you extra money if you spend a certain amount within a certain timeframe. Don’t go signing up for every credit card that has a good bonus. Keep it to 1-3 credit cards and leave it at that. I’ve worked with people that have 20+ credit cards and they don’t know which way is up. It’s not worth it. Trust me there are better ways to make money (we’ll talk about that in the next part of this series). The other trap I see people fall into with bonuses is that they will spend extra money to reach the bonus. This is exactly what the credit card companies want you to do. It defeats the purpose. Only sign up for a bonus if you know that you will naturally reach it.

If you are already in debt, pay the minimums on all your credit cards and then pay as much as you can on one of them. By knocking out one balance, you get a win that builds confidence and keeps you motivated to continue paying off the rest. Either focus on the one with the highest interest rate or the lowest balance. If you pay the one with lowest balance you will pay it off the quickest which will feel good and help you build momentum. If you pay the one with the highest interest rate you will save the most money. It’s a personal choice, so go with whichever feels better for you.

Clients that follow these steps, make credit cards work for them instead of the other way around.

Misc Bills

For the most part you should put everything on your credit card so that you can take advantage of the bonuses that the credit cards offer you. For those occasional things that you can’t pay by credit card set it up to have them automatically come out of your bank account (BE SURE TO ENTER THAT IN YOUR BUDGET AS A RECURRING EXPENSE).

Action Steps:

Check to see if you have 401K and if your work offers a match. If so, set it up so that you automatically contribute up to whatever your company is matching

Look into ROTH IRA options

Set up savings accounts with a separate bank and give each of them a goal.

Set up your credit card to automatically pay off the statement balance every month.

If you are in debt, pay the minimums and then pay as much as you can toward either the highest interest or the lowest balance card.

Anything that can’t go on your credit card set it up to automatically get paid out of your checking account.

Start with small wins—whether it’s setting up automatic transfers to savings or contributing to your 401K. These steps compound over time and put you in control.

A lot of these actions steps are simple but not necessarily easy. What a lot of my clients realize once they start coaching is that a big advantage of it is just having someone to help them with the implementation of things. Coaching often offers the guidance and accountability needed to make these plans a reality. If you feel overwhelmed or want personalized support, I would love to have a free no-pressure call where I offer any help I can. Let me know you’re interested here:

“Well okay Sean, I’m making decent money and I can save and invest and everything, but I wanna know how to get RICH!” That’s what the last part of this series is for. Next time we’ll talk about how to build your own business!

I’m here to serve you! That’s right you the one reading this right now! So if there are things that are really helpful for you, don’t make any sense, or even things I’m just not talking about at all please let me know here so I can better serve you:

And finally, who is someone in your life that is really struggling with their finances? That person that just popped into your head share this article with them so that they can have a better relationship with their money too: